The dealer tech shock: a dilemma all dealers are facing

The successful construction equipment dealer of 2034 will look a lot different than the dealer of today, say Maria Metz and Carl-Gustaf Goransson from automative and construction equipment consultancy abcg.

|

| It will take years to fully form, but construction equipment is transitioning to becoming fully electrified. This will have several important implications for dealers. |

Despite a pulling in of reins in 2024, the global construction equipment industry is still galloping along at historically high levels – with forecasts indicating still more growth in the years ahead. This is good for construction equipment manufacturers (OEMs) and their dealers. However, the future of the industry is definitely not going to be business as usual. Although experiencing a sluggish start, widespread electrification of equipment IS going to happen, and this, coupled with the global trend for machines to be both more connected and increasingly autonomous means the business model dealers have relied upon for many years has to change. We’re not just talking about adding a few digital technologies and services, what is going to happen will fundamentally shift the traditional relationship between dealer and customer – and the OEM and dealers.

Three into one does go

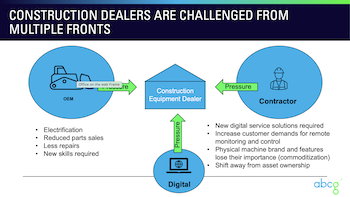

Construction dealers are an integral part of the supply chain between OEMs and construction customers. They play a key role in not only distributing equipment and parts, but also in servicing equipment. However, the industry is changing on several fronts. At the consultancy firm abcg, we call this the ‘triple technology challenge’: Electrification, Digitalization and a business model change.

It will take years to fully form, but construction equipment is transitioning to becoming fully electrified. This will have several important implications for dealers. Many electric components have a longer life cycle than current mechanical or hydraulic components. When equipment is powered by batteries and motors rather than a combustion engine, this will have a profound impact not just parts sales revenues, but also income from engine overhauls and rebuilds – and much else besides.

And whereas once OEMs took a hands-off approach to dealing directly with end users and the buyers of their equipment, now they are increasing the customer facing software supplied with their equipment. The dealers have often no corresponding revenue stream from this software as they cannot add much value.

Dangers on many fronts

Just as in all other aspects of our lives, the customer is getting more technically sophisticated. Not just large contractors but also medium and small players expect more digital information. This could be to locate or remotely operate or monitor equipment, or to schedule repairs or machine rentals. This can already be done through marketplaces on different platforms and risks cutting out the dealer (or at least further reducing the relationship between the dealer and the customer). The increased use of BIM (Building Information Modeling) software by building companies and contractors is a good example of a change in the industry.

This revolution of the industry will not happen overnight but will most likely be an ongoing evolution that takes a decade or even longer. Also, certain regions will move quicker than others. Regulations on emissions will drive the speed of transition. So, this isn’t going to happen overnight, but even so, the lead time to adapt to changes being driven by the triple technology challenge is long and dealers cannot wait to act. Dealers need to take action now. Just developing or hiring employees with new skills will take time. Also new investments need to be evaluated based on future needs.

Don’t throw the baby out with the bathwater

Critical to the strategy will be to determine what key attributes the dealer of the future needs to keep, what can be discarded – and what needs to be developed. One thing is for sure: dealers need to remain the trusted resource of their customers. OEMs and digital players will come in closer contact with the customer, but they can never have the close, personal relationship local dealers have with customers.

Dealers also do the invaluable task of reporting back to OEMs the voice of the customer. Most OEMs will never have the local in-the-dirt knowledge of the customer and their needs.

Dealers need to secure and develop new skills needed to thrive in the industry of the future which will get here sooner than we think. Both in the service department and in the customer management and care section, the transformation of the dealership with new people and skills will allow for the development of new services and digital solutions. This should allow the dealer to make up for the shortfall of the profit margin on parts, labor and equipment that is bound to happen with the rapidly evolving changes to the construction equipment dealer business model.

Better use of digital and AI tools can also support the sales process and reduce costs. Efficient and proactive office support to field personnel will become the norm. For example, with remote monitoring of equipment, dealers can schedule all maintenance, repairs and replacement in advance.

Most construction dealers are aware of the challenges that face them. But equally, most haven’t started to work on their strategies to make sure they remain in control and profitable in the future. If the electric, connected, autonomous and diversified industry of the future isn’t to steal their lunch, dealers need to start planning and executing their change management programs.

About abcg

Comprised of a network of commercial vehicle industry experts, abcg delivers accelerated and sustainable transformation that propels business performance from good to exceptional. With an unbiased approach and a hands-on implementation style, it provides flexible and tailored programs around business growth, innovation, leadership and portfolio management, that specifically target clients’ needs. It is committed to equipping businesses with the tools to meet the ever-changing capital goods industry.