Excavator and loader outlook

Small machines are digging the market out of the COVID hole.

by Alistair Hayfield

Researchers at Interact Analysis present an insight into likely market performance in the earthmoving equipment sector. As with the rest of the off-highway vehicle sector, the COVID-19 pandemic caused severe market contractions in 2020 for the earthmoving sector. Excavators and wheel loaders, saw negative growth in Europe of -22 percent and -16 percent respectively.

The outlook looks positive for the mini- and medium excavator markets and the market for compact wheeled loaders also looks healthy. Larger machinery will see a more sluggish recovery and market growth.

Smaller excavators expect a significant hike in market share out to 2029

Excavators have a higher predicted growth rate than loaders. Hydraulic excavators have become particularly popular in a range of settings and they are replacing wheeled loaders in coal mines. Meanwhile, mini excavators are gradually replacing backhoe loaders, an earthmoving concept which has been around since the 1950s.

The mini excavator market was the first earthmoving sector to see a post-COVID-19 recovery, which was detected in 4Q 2020. There is strong demand for these machines in North America and China and their share of the global excavator market is predicted to rise from 44.8 percent in 2019 to 49.3 percent in 2029. Medium excavators are also expected to see sustained growth, but their initial recovery will be slower; while the mineral extraction sector continues to be badly affected by COVID-19, the large excavator market will lag behind.

China’s race to modernize and extend its infrastructure to support its burgeoning economy has made it the biggest regional market for excavators. In 2019, 35 percent of global excavator sales went to China, with Europe in second place on 21 percent. As an interesting comparison to this, during 2020 China’s market share rose to 47.6 percent, as China bucked the trend, being the only region where the excavator market saw year-on-year growth (37 percent). We expect China’s demand for excavators to remain strong going into 2021, though the growth rate is likely to flatten a little.

Predictably, demand for larger excavators is greater from emerging economies where there are more major infrastructure projects. Conversely, developed countries such as the United States, Japan, Germany and France currently account for 60 percent of the mini excavator market where these machines are usually purchased by rental companies and are hired out for use in urban settings where modernization projects are often executed in enclosed environments.

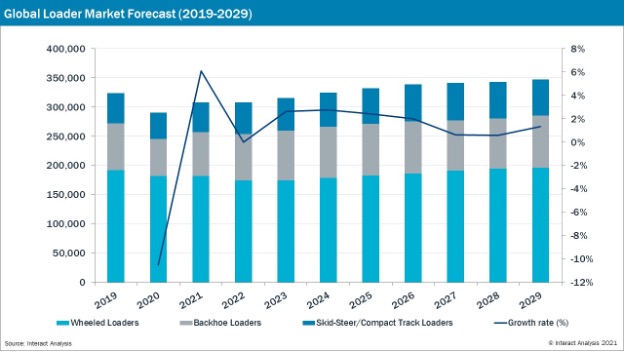

Investment in loaders: Post-COVID surge, then stability

As construction activity picks up across the globe, demand for compact machinery such as skid-steer loaders and compact wheeled loaders is increasing. Interact Analysis researchers anticipate a surge of investment in loader equipment over the course of 2021, with a consequent dip in 2022, followed by a slight rise and overall levelling off as the market stabilizes.

As shown in the above chart, wheeled loaders, which are used widely across all regions, willl continue to occupy the largest market share. China accounts for over 50 percent of the market.

As with excavators, it is compact machinery that will see the greatest demand, particularly in developed countries. Germany, France and Japan accounted for 75 percent of compact wheeled loader shipments in 2019. Interact Analysis researchers anticipate growing demand for compact machinery in developing markets such as South America and South Asia as infrastructure projects grow there.

Skid steer loaders are forecast to see gradual growth up to 2029. Their principal market being North America, which has accounted for 80 percent of sales of these machines.

The backhoe loader market, where India has accounted for almost a 50 percent share, remains consistent and significant throughout the forecast period. Low interest rates in Europe and tax subsidies encouraging the replacement of old machinery with new energy vehicles have given contractors the confidence to invest in new loader equipment in Europe. Additionally, stringent emissions standards are driving the market for electrified compact wheeled loaders.

Full electric and hybrid making inroads, but it’s a slow process

As with most vehicles, so it is with earthmoving machines: the larger they are, the more difficult it is to insert a practical alternative energy solution due to issues around battery capacity, range, charging infrastructure and downtime for charging. That said, as most large machinery is used in environments where emissions controls are less strict, such as in out-of-town settings, the impetus to electrify is much weaker.

Interact Analysis researchers forecast that around only 6.2 percent of all large excavators (30+ tons) sold globally in 2029 will be electrified. New energy solutions for medium-sized excavators (20+ tons), have centered so far around the concept of the hydraulic hybrid swing and are showing signs of extending into full electric options, with companies such as Volvo and Komatsu researching this technology.

The category most likely to see a real push for electrification is the mini excavator, the machine often being used in environments where noise and pollution controls are stringent. There are already thousands of these battery-electric machines in commission, such as the Volvo ECR25 Electric. Interact Analysis researchers forecast that the penetration rate for electrified powertrains for these smaller machines will stand at a significant 18.6 percent by 2029. Overall, by 2029, 13 percent of global excavator sales will be of full electric machines, Interact Analysis researchers predict.

Predictably, the outlook is similar for compact wheeled loaders, where there will be higher rates of electrification as compared to large machines. The Kramer 5055e is an example. The push to improve efficiency and reduce costs in larger wheeled loaders may in fact lead to a general scaling down in the average size of these machines, enabling electrification, which will in turn reduce the number of components in the machines, resulting in less wear and tear and maintenance work, which all incurs a price.

A note on Biden

Looking forward, things are likely to be more positive in the United States than Interact Analysis' numbers currently show. The reason for that, of course, is the much-discussed $2 trillion Biden infrastructure plan, which includes fixing 20,000 miles of roads and 10,000 bridges. Like China’s post-COVID infrastructure plan (which is baked into the numbers in this report) should the United States plan come to pass, it will give an important boost to the country and, potentially, the global off-highway vehicle market.

Alastair Hayfield is senior research director at Interact Analysis, an international research firm that specializes in industrial automation, robotics and warehous automation and commercial vehicles.

Learn more at www.interactanalysis.com

Alastair.Hayfield@InteractAnalysis.com